Annual Report – Financial Overview

Year ended March 31, 2024

Financial Highlights

Statement of Comprehensive Income

| (In thousands of dollars) | 2024 Budget | March 31, 2024 Actual | March 31, 2023 Actual |

| Revenue | 39,539 | 36,849 | 37,250 |

| Expenses: | |||

| Operations | 6,202 | 5,796 | 5,009 |

| Maintenance | 5,122 | 5,349 | 4,022 |

| Administration | 3,685 | 3,581 | 3,159 |

| Amortization of property and equipment | 11,075 | 10,165 | 10,283 |

| Total Expenses | 26,084 | 24,891 | 22,473 |

| Operating Income | 13,455 | 11,958 | 14,777 |

| Net Finance Costs | 4,311 | 3,073 | 3,304 |

| Comprehensive Income | 9,144 | 8,885 | 11,473 |

Halifax Harbour Bridges (HHB) was created in 1950 by a statute of the Province of Nova Scotia and is a Government Business Enterprise (GBE) as defined by the Public Sector Accounting Board recommendations. As such, HHB prepares its financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

Revenues of HHB are 100% derived from tolls and fees based on traffic volumes on the Angus L. Macdonald and A. Murray MacKay Bridges. Traffic volumes in fiscal 2023-2024 continued to improve following the COVID-19 pandemic with traffic finishing at 98.7% of pre-pandemic levels (prior year 94.6%). The 2024 budget assumed traffic levels at 100% of pre-pandemic levels contributing to the actual toll revenues being below budget. Toll revenues were lower than the prior year despite an increase in traffic volume due to a change in the mix of traffic with less commercial traffic recorded in fiscal 2024 and an increase in toll violations. The drop in commercial traffic is unusual and believed to be at least partly attributable to poor performance of the toll system. To address this, HHB has since replaced certain toll equipment as well as increased staffing in the toll plazas and has observed improvements in both commercial vehicle classification and reduced violation rates.

Operations includes the costs to staff the toll facilities, bridge patrol, the MACPASS Customer Service Centre and maintain the tolling equipment and IT infrastructure. In fiscal 2024, costs exceeded the prior year due to higher wage rates for toll facility staff and higher IT costs. Costs were below budget due to timing for certain IT projects.

Maintenance expenses include costs of maintaining the structural integrity and operational standards of the bridges along with upkeep of buildings and equipment. These costs include snow removal, corrosion protection through painting, consulting engineering fees and operational costs of buildings, vehicles and properties. Maintenance costs increased in fiscal 2024 versus prior year due to the cost of detailed inspections primarily on the MacKay Bridge structure and piers. Additionally, wage expenses increased as staff were added to complete a greater number of projects. Maintenance costs exceeded budget due to inspection related costs for the rental of specialized equipment to access hard to reach areas of the bridge as well as vehicle repairs exceeding budget and certain wages being expensed rather than capitalized to projects.

Administrative expenses include insurance premiums, professional fees, property taxes and wages for accounting, treasury and public relations functions. In fiscal 2024, administration costs were lower than budget with less spending on communications due to timing and lower consulting fees than planned. Administrative costs rose compared to the prior year with increased insurance costs and increased consulting costs.

Amortization of property plant and equipment is a non-cash charge that represents the cost of HHB’s long-term capital assets over their expected useful life. Amortization was lower than budget in fiscal 2024 as several projects were not completed which delayed the start of amortization.

Net finance costs consist of interest costs for HHB’s long term debt offset by interest income earned on cash held in operating and loan reserve accounts. In fiscal 2024, net finance costs were lower than budget as the budget had assumed a new issuance of long term debt that was not drawn in the year as the Commission required lower borrowings than planned and made use of a line of credit facility. The decrease in Net finance costs from the prior year is due to increased interest earnings on reserve balances offset by interest expense on the line of credit balances.

Financial Highlights

Statement of Financial Position

| (In thousands of dollars) | March 31, 2024 | March 31, 2023 |

| Current Assets | 5,347 | 9,502 |

| Restricted Funds and Property Plant and Equipment | 316,705 | 296,577 |

| Total Assets | 322,052 | 306,079 |

| Current Liabilities | 34,277 | 19,504 |

| Long term debt | 122,315 | 130,000 |

| Equity | 165,460 | 156,575 |

| Total Liabilities and Equity | 322,052 | 306,079 |

HHB’s 2023-2024 audited financial statements are found at www.hdbc.ca/publications.

HHB’s Statement of Financial Position has an increase in total assets of $16.0 million offset by an increase in liabilities and debt of $7.1 million. These changes are the result of improvements being made to the bridges under HHB’s 10- year plan financed through a combination of tolls and draws on the line of credit facility. Current assets consist primarily of cash at $4.1 million and current liabilities include deferred revenue of $5.1 million which represents customer deposits in their MACPASS accounts, cumulative line of credit draws of $15.0 million and the current portion of long term debt of $8.0 million.

Equity has increased in fiscal 2024 with positive comprehensive income recorded for the year. Approximately $16.4 million of the equity balance is recorded as a reserve for restricted assets, comprised of funds set aside under various loan agreement terms.

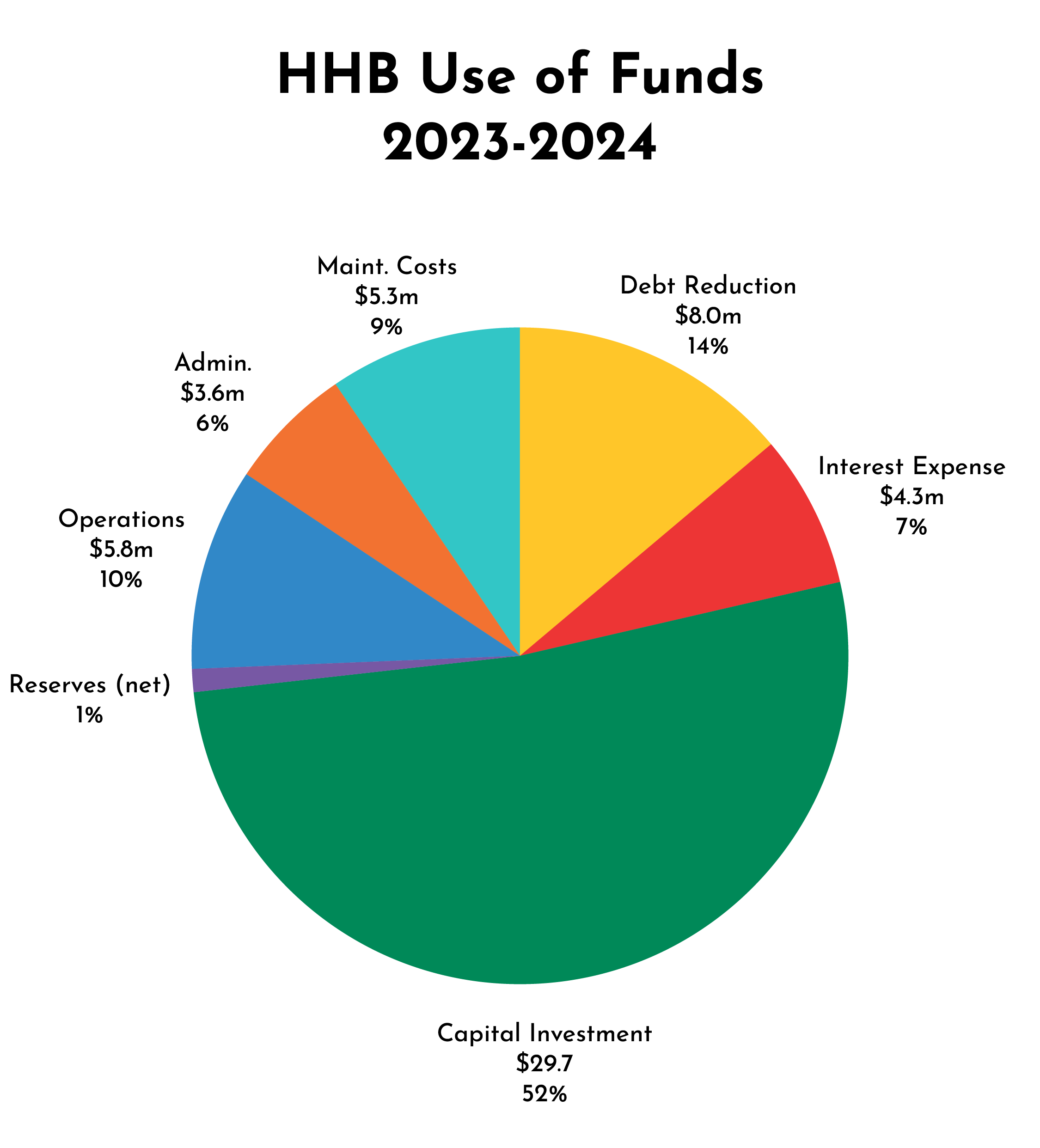

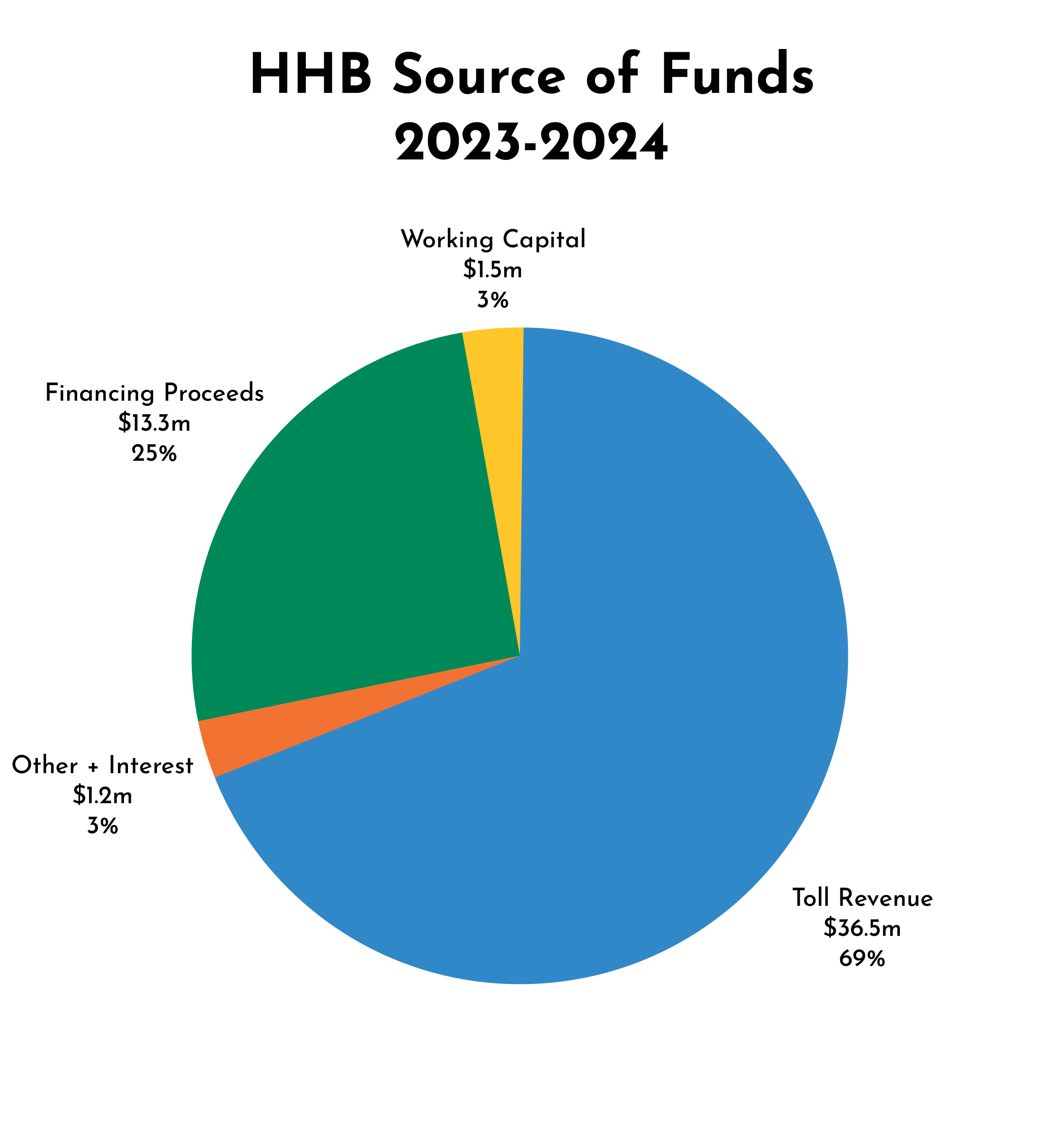

The two charts above summarize data from the statement of cash flows included in HHB’s audited financial statements. The charts illustrate how HHB obtained funding in fiscal 2024 and how the money was spent.

In fiscal 2024, toll revenues of $36.5 million accounted for 69% of the cash required to fund operations, debt servicing and capital investment.

HHB invested $29.7m in capital assets in fiscal 2024, the highest annual amount since the conclusion of the Big Lift project. The capital investments were primarily improvements to the Bridges to extend their useful life such as steel rehabilitation and coatings work on the Macdonald and deck panel replacements on the MacKay Bridge. Debt servicing totaled $12.3 million and includes principal repayments of $8.0 million and interest expense of $4.3 million. The cash requirements to fund the day-to-day work of HHB and bridge operations is represented by the categories of “Operations”, “Maintenance” and “Administration” totaling $14.7 million as discussed in the review of the Statement of Comprehensive Income.

Data for above charts from Statement of Cash Flows, part of HHB’s 2023-2024 audited financial statement located at www.hdbc.ca/publications